fha gift funds cousin

Gift funds are monies given to a borrower to help with a home purchase. The portion of the gift not used to.

Gift Funds When Is A Gift A Gift According To Fha

If your credit score is between 580-619 you have to contribute 35 toward your down payment from your own funds.

. For example a man could sell his house worth 100000 to. Ad Get Preapproved Compare Loans Calculate Payments - All Online. The very long standing standard mortgage loan rules require gift money to be from a blood relative or a substantial person with a documented interest in the buyer.

When an FHA borrower receives help from their relatives or a seller that contributes to or runs an affordable housing program it is considered a gift of equity. As an alternative if you have a trusted relative willing to help out you could ask you friend to give the money to them and then have them gift it to you. George resides in Middlesex.

The gift letter must. However the FHA does allow for gifts from close friends and under. Gift funds are commonly used for home loan expenses including.

Obviously use common sense and dont. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower. The gifted funds must be sourced and seasoned and cannot be borrowed by the donor.

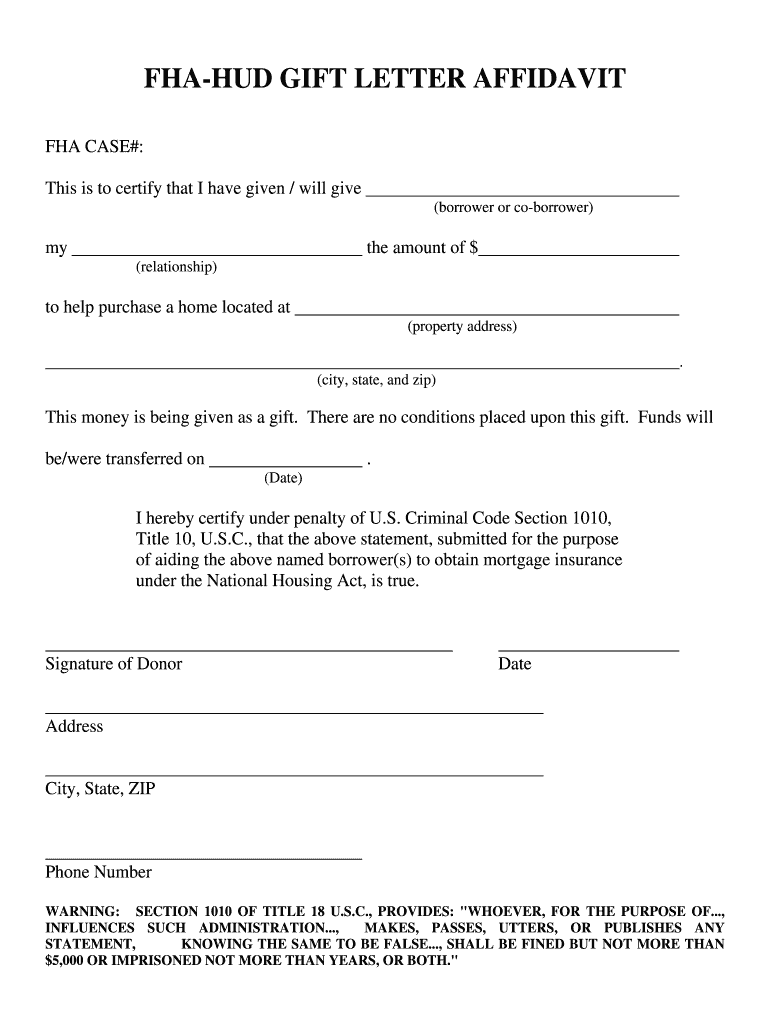

Specify the dollar amount of the gift. Gifts must be evidenced by a letter signed by the donor called a gift letter. If you are applying for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient acknowledging the warning stated in that section.

FNMA B3-43-04 dated 09292015 and. Gift Funds-Down payment funds can be gifted from a relative spouse or a domestic partner. A family member can also use equity in a property as gift funds.

This gift is to be used to cover the. FHA does allow gifts from approved charitable organizations government agency public entity and close friends who have a clearly defined and documented interest in the. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

With FHA loans all of the above are acceptable as gift donors except nieces nephews and cousins. That depends on your credit score. First things first the answers below to the top 5 questions can be found in the guidelines under.

FHA loan rules in HUD 40001 have specific guidelines where gift funds to the borrower are concerned. The Federal Housing Administration FHA released a proposed rule earlier this month that would add a 40-year loan modification option to its loss mitigation options. A gift can be provided by.

A relative defined as the borrowers spouse child or other dependent or by any other individual who is related to the borrower by. For FHA loan approval borrowers can use the gift funds for a down payment closing costs or reserves. George Souto NMLS 65149 is a Loan Officer who can assist you with all your FHA CHFA and Conventional mortgage needs in Connecticut.

Gifts toward down payment do not have to always be in cash.

Fha Gift Funds Guidelines 2022 Fha Lenders

Remember When I Used To Blog Regularly Words Inspirational Quotes Great Quotes

Fha Loan Rules For Down Payment Gift Funds

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Fha Gift Funds How Can I Use Them To Buy A Home

Pin On Alwynne S Homemade Cakes

Fha Hud Gift Letter Affidavit Fill And Sign Printable Template Online Us Legal Forms

Dark But It Is The Truth Be Careful How You Speak To Children Inner Voice Spreuken Woorden Teksten

Fha Gift Funds How Can I Use Them To Buy A Home

Fha Gift Funds Guidelines 2022 Fha Lenders

Fha Gift Funds How Can I Use Them To Buy A Home

Fha Gift Funds How Can I Use Them To Buy A Home

Down Payment Gift Rules From A Friend Or Relative

Fha Down Payment And Gift Rules Still Apply

Fha Gift Funds Definition And Guidelines Rocket Mortgage

Mortgage Down Payment Gift Rules Who What Why A Letter

Qualify For A Jumbo Loan How To Use Gift Funds For A Down Payment